Merrimack College recently launched a student-managed fund to explore investment options in the fast-growing digital currency ecosystem.

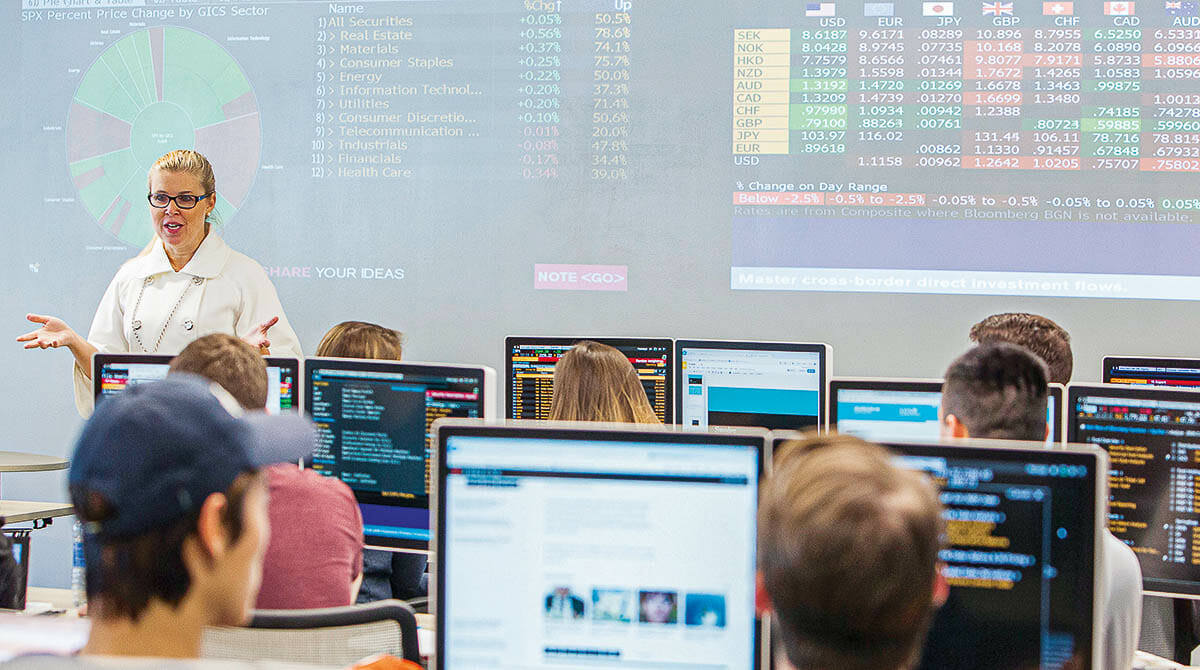

Under the direction of Mary Papazian, managing director of the Mucci Capital Markets Lab in the Girard School of Business, the Merrimack Alternative Investment Fund will use real money thanks to a donation from Paul and Joyce Mucci P’07 to give students unique opportunities to buy into different types of assets with exposure to Blockchain technology and cryptocurrency.

“The Alternative Investment Fund’s mission is to provide students a forum to discuss topics related to the rapidly developing Blockchain technology, digital assets and the metaverse,” said Paul Papageorgiou ’23, founder of the Blockchain and Cryptocurrency Organization student group. “We aim to understand the advantages of using cryptocurrencies and how it can be used at a worldwide scale in a peer-to-peer exchange on a decentralized platform.”

The fund will look at the investment options in cryptocurrency mining companies, exchange-traded products that track specific coins and other assets such as gold and foreign exchange. The Blockchain and Cryptocurrency Organization student group meets weekly to discuss the overall markets, participate in a simulated competition to explore different coins and execute ideas and investment options for the Alternative Investment Fund.

“This is an amazing opportunity for students to get in front of a dynamic changing landscape and make real-time decisions,” said Papazian, faculty advisor and founder of the Merrimack Investment Fund and Fixed Income Fund, which currently have more than $450,000 assets under management. “It’s a very different experience when you are in a simulated environment versus managing real monies. The engaging and timely conversations that happen in the student meetings are exactly what is happening in firms around the world.”

The Mucci Capital Markets Lab continues to provide innovative ways for students to get real-world perspective and hands-on experience in the business and finance fields, allowing students to graduate with unique skill sets, real work experience, certificates in innovative technologies and the ability to pass the Securities Industry Essential exam.